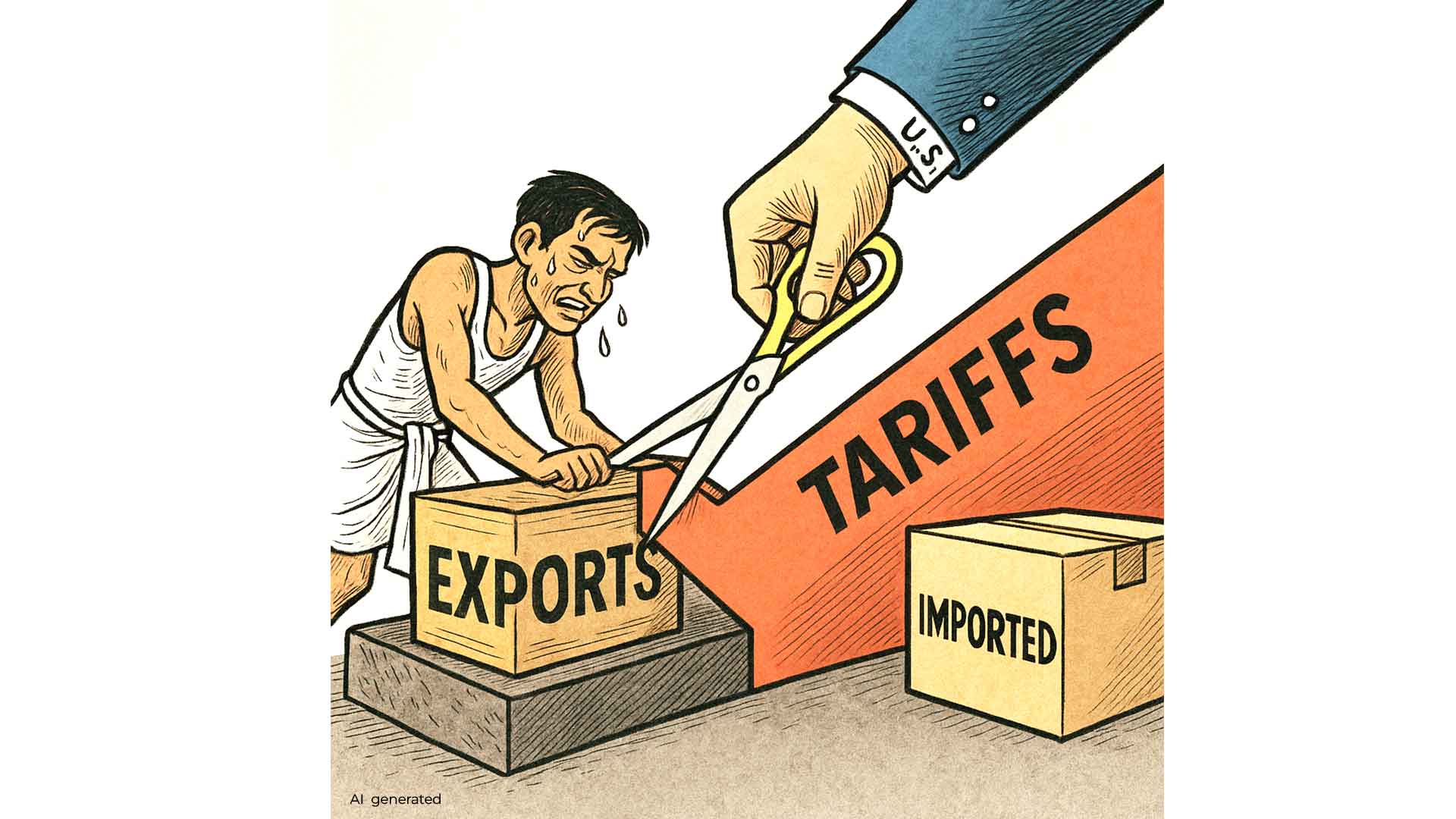

The implications of this are many-fold. A direct implication of this is that firms based in India are more likely to import commodities from the US due to lower costs. This could hurt Indian companies competing with US products in Indian markets, either putting them out of business, resulting in widespread job losses. Alternatively, Indian businesses may need to further reduce their prices to remain competitive, but any reduction in prices would then mean lower revenue, ultimately resulting in lower wages in the workers employed in these firms.

A bigger problem, however, is to do with an increase in imports from the United States. International trade between a developed country like the US and a developing country like India is inherently unequal. Everything from the cost of wheat to the cost of an hour’s work is higher in the United States. Thus, a standard manufactured commodity in the US is more expensive than the same commodity manufactured in India. Therefore, when India and the US exchange commodities, India needs to export more goods to offset a smaller volume of expensive imports from the US. What further worsens this situation is that most goods (barring crude petroleum) that India imports from the US, are already expensive, such as sophisticated heavy machinery, expensive pharmaceuticals, and vehicle parts, while India exports low-cost goods like agricultural products like rice, generic medication, readymade garments, and petroleum products. As a result, the volume of commodities traded between India and the US are lopsided and unequal.

In Marxist economics, this phenomenon is called Unequal exchange, and it facilitates the accumulation of profit and capital in rich countries at the cost of workers in the Global South. Since every good is the product of human labour, there are billions of hours of labour embodied in these exported goods. The larger the scale of exports, larger is the quantity of labour exported India. On the contrary, since the US exports a much smaller volume of goods to India, India receives a much smaller amount of embodied labour from the US. To put this in numbers, in 2017, India imported 795 million hours of embodied labour from the US, while it exported a staggering 56 billion hours, over 7 times as much as it imported! The difference comes out to be 55 billion hours of Indian labour effectively drained from the country to the US alone. These are hours of crucial work that could be redirected towards the development of the country and instead is used to serve capital accumulation and overconsumption in the United States. This phenomenon also implies that the more India imports from the US, the more it has to (disproportionately) export.

With the Indian government slashing tariffs on US products, imports from the US are likely to rise, which would mean India would have to proportionately increase exports, if it wants to avoid running into a trade deficit. However, since Indian exports were already at low tariffs before the Trump administration, it is unlikely to benefit significantly from free trade agreements with the US. To then bring about an increase in exports, Indian commodities would have to attract more buyers than they currently do. The most effective macroeconomic policy that could cheapen exports is a currency devaluation, which would only make matters worse for Indian consumers. Regardless of what short-term policy the government employs, one consequence is certain – tariff reductions will increase imports, and Indian workers would have to work more to avoid a trade deficit.

Until last year, the United States was one of the very few large economies of the world with whom India had a large trade surplus, despite India overall still suffering from trade deficits year-after-year, unlike competing economic powers like China. Since India imports more than it exports, India is at a constant requirement of foreign currency, usually the US dollar. If India’s trade surplus over the United States reduces, or turns into a deficit, then India’s existing foreign exchange reserves will deplete further. As the demand for foreign currency in India increases, the relative demand for the Indian rupee decreases, and the Rupee will continue to fall, making imports expensive. This will have various negative consequences. For consumers who depend on certain imported goods, such as smartphones, the cost of these goods will increase. For manufacturers, a currency devaluation would mean an increase in the cost of imported intermediate inputs. This would ultimately mean either a higher cost of goods for consumers, or lower wages for workers. For the government, this would mean greater costs on key imports – predominantly in natural resources and defence. Greater government expenditure on purchases, would imply lower government expenditure on welfare schemes, which will only worsen the trend towards austerity in India, and government expenditure that benefits India’s farmers, workers, and masses would shrink.

These problems must also be understood in the context of India’s new “Free trade agreements” (FTA) with the European Free Trade Association in 2024, and the United Kingdom, earlier this month. While the government of India claims that these agreements will bring investments and create jobs, this is unlikely to benefit Indian producers, as these investments would be centred around multinational corporations selling their commodities in India. It is also important to note, that India’s advantage in international trade partly comes from low labour costs in India, and India stands little to benefit from FTAs, as Indian exports are already extremely lucrative and competitive in international markets. FTAs are neither free nor fair, when between a wealthy country like the US or UK and a developing economy like India, and they only result in greater freedom for multinational corporations to operate in India at the cost of Indian workers.

Thus, when other political powers like China and the European Union are approaching US’s tariffs with retaliatory tariff hikes, it is strange that the Indian government is employing a strategy of tariff reductions and reducing trade protections. While this would benefit American producers, as intended by the US government, it will only hurt Indian producers and workers in the long run. Instead, the government must focus on developing Indian industries and reducing dependence on imports. True development of India can only come from self-sufficiency, and economic sovereignty.